Learning Update — August 4, 2021

Origins of civilization, evolution of writing, and cuneiform script.

The Start of Western Civilization

One thing I’ve been learning (or, trying to learn) a lot about recently is, sort of, the “flow” of civilization — from as far back as possible.

For example, where did all the biblical texts come from? What languages were they written in? How did those languages change? What is a neat and tidy narrative to understand all that?

And that’s the problem: I’m learning a lot, but I can’t really neatly sum it all up (for myself or for you!) into a neat narrative. So it can feel like I’m learning nothing.

There’s lots to say, but for now I’ll start with cuneiform, the script used in Mesopotamia for many languages.

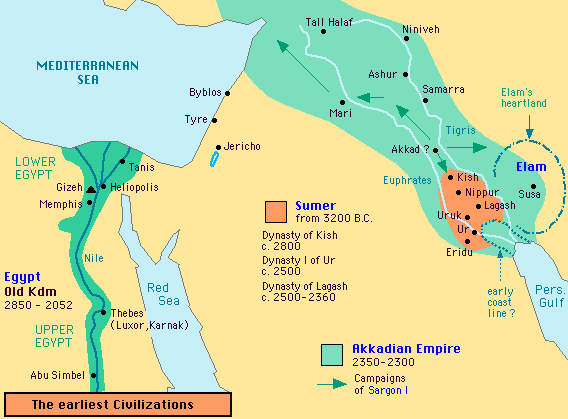

First, a quick background of some things that I know, or think that I know:

The Coptic language is the modern descendent of Ancient Egyptian.

Hebrew, Arabic, Akkadian, Aramic, Phonecian, are all “Semitic” languages, very closely related each other from a common ancestor.

Sumerian, one of the dominant languages in Mesopotamia, is not linguistically related to any of the other surviving languages in the region. In fact, it is a “language isolate” without any living descendants. Sumerian, however, developed the Cuneiform script which was widely adopted by other languages in the region for writing.

Every modern language uses some adapted version of the Phoenician alphabet, itself based on earlier Phoenician hieroglyphs (possibly derived from Egyptian Hieroglyphs).

Completely random, but: Carthage (modern Tunis) was a Phoenician colony, that later become a major power in its own right.

The Old Testament is, among other things, a hodgepodge of myths from Ancient Mesopotamia and Ancient Egypt. Ancient Mesopotamian and Egyptian mythology never really disappeared. (Neither did the languages.)

Cuneiform and the Evolution of Script

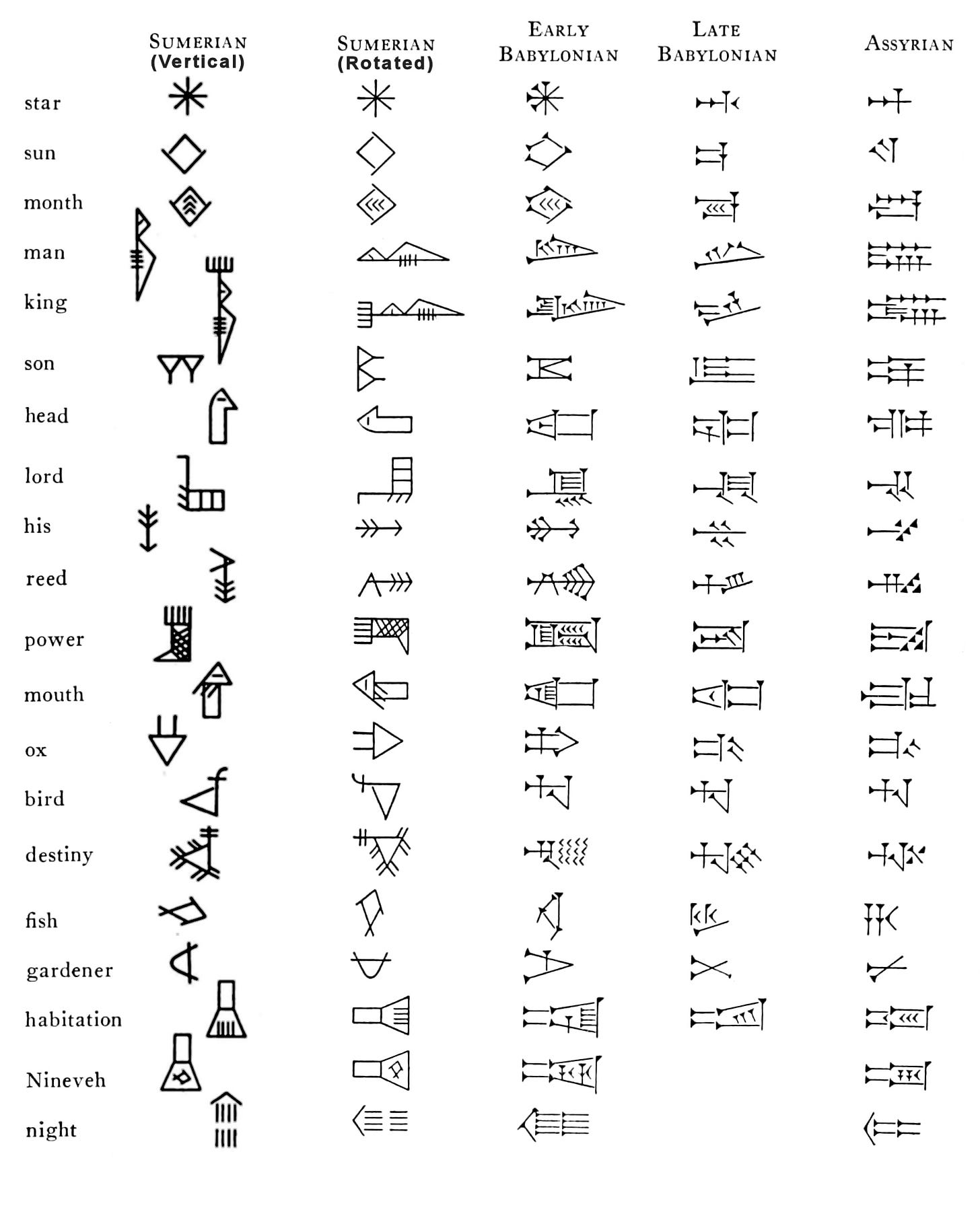

Cuneiform script was originally developed to write Sumerian, but was then used by other languages in the region, including Akkadian, Old Persian, and other languages I’d never heard of. It was a very widely used writing system, much like the Latin alphabet (what you’re reading right now) is today.

Cuneiform is written by making wedge imprints in clay. How the script developed is fascinating. It started out as pictoral hieroglyphs, and linguists have been able to map out the evolution of the original hieroglyphs into abstract symbols over time.

This example taken from Wikipedia:

First the hieroglyph rotates so that it can be placed horizontally. Then it gets simplified and abstracted over centuries; millennia.

Somewhere along the way, these pictographic elements started to be used for phonetical values (sounds), allowing you to write a generic word or sound for any idea or name. And, as mentioned, it allowed cuneiform to be used to write other languages too, since any sounds could be expressed. And so they did.

Here are more examples of that evolution:

We (english speakers) inherited our alphabet much the same way through Latin via Phoenician via “Proto-Sinaitic” Hieroglyphs via Egyptian Hieroglyphs:

And so here we are.

Indeed, the Phoenician script is the ancestor of all major language scripts used today west of China. (Major wow.)

One thing I didn’t know until recently was that Egyptian hieroglyphs, though pictorial representations of actual objects, were themselves used to represent phonetic sounds as well; and that the Ancient Egyptians also had a corresponding abstract, shorthand script to represent those sounds.

And then I learned that, of course, Chinese characters started as hieroglyphs too!

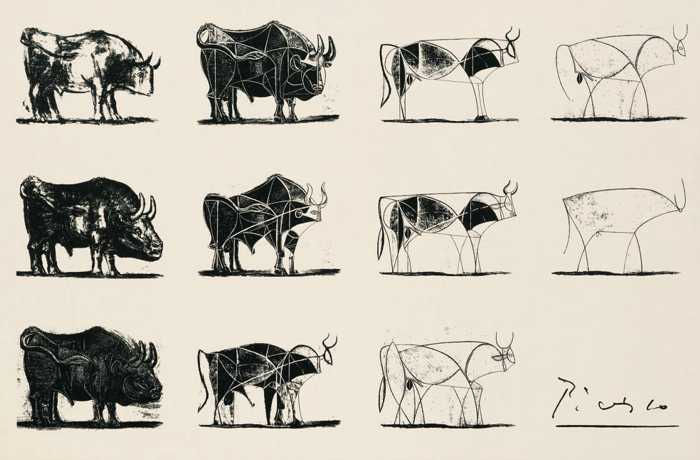

So this is a general pattern. It seems that all scripts start as pictures.

It all reminds me of Picasso’s bull study, famously used by Apple to teach its employees (“Apple University”) about the Apple design process.

An important question I don’t have an answer to is: why did cuneiform die out? Cuneiform has no descendent scripts. What causes such a dominant, universal script to die out? The explanations I’ve come across so far are not compelling enough.

BONUS: Here is a 53 second video showing how cuneiform was written on clay tablets. It’s magical.